Benefits

Solar Initiative Tax Credit (SITC)

The most important information about solar regarding solar benefits for New Jerseyans include:

Solar Initiative Tax Credit (SITC)

A tax credit is a direct reduction in the amount of income tax you owe, effectively decreasing your tax bill by the credited amount. Specifically, the federal solar tax credit is applicable to residential solar energy systems, allowing homeowners to claim a portion of the system's cost as a credit on their federal income taxes. This credit is not limited to solar energy alone but extends to other renewable energy sources as well, though our focus here is on solar.

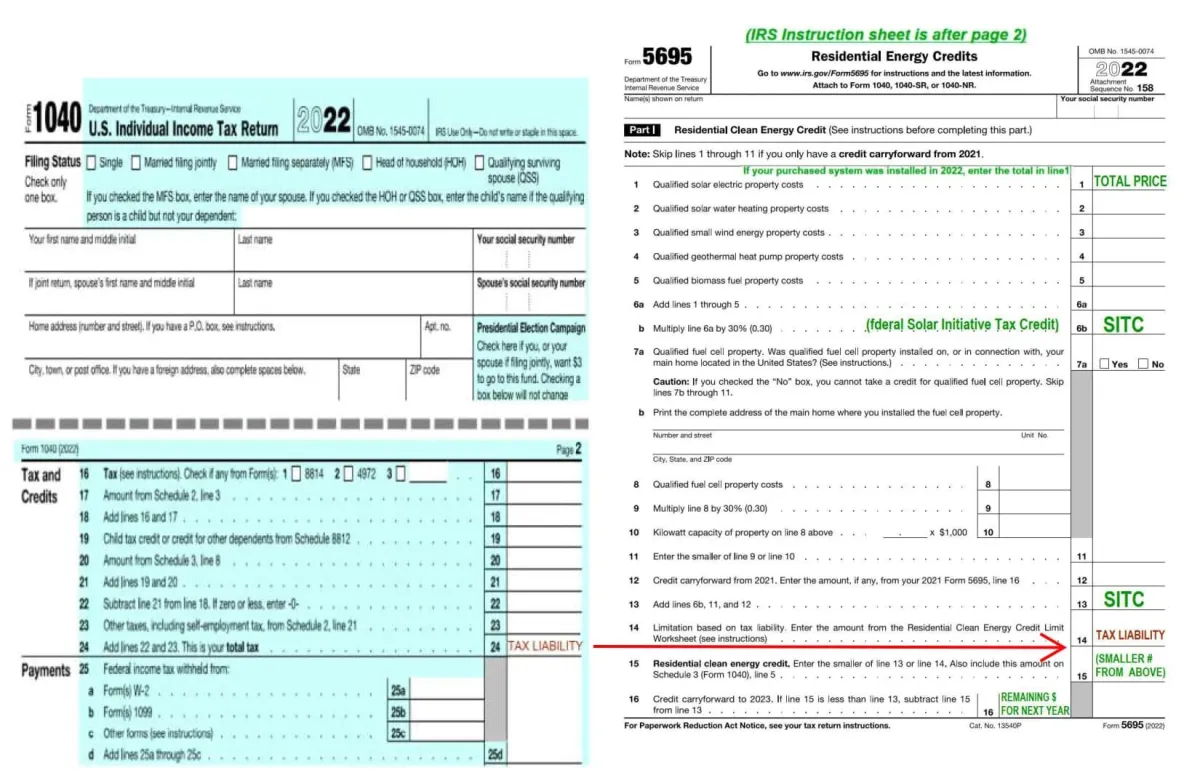

Please see the video for a basic How-To for claiming the SITC. I have also included the color coded sample form and a link to the form from IRS at the bottom of this page.

To qualify for the federal solar tax credit, your solar PV system must have been installed between January 1, 2017, and December 31, 2034, and must be located within the United States. Additionally, you must either own the system outright or have purchased an interest in an off-site community solar project. The system must be new or being used for the first time, and the credit can only be claimed on the original installation of the solar equipment.

Expenses covered by the tax credit include not only the solar panels themselves but also contractor labor costs for installation, permitting fees, inspection costs, and other related expenses. Additionally, certain balance-of-system equipment like wiring, inverters, and mounting equipment, as well as energy storage devices meeting specific criteria, are eligible for the credit. It's important to note that sales taxes on these eligible expenses are also included. This tax credit provides a significant incentive for homeowners to invest in solar energy, offering financial benefits while promoting the use of renewable energy sources.

NOTE: This is the experience I've had with a customer, but

this is NOT advice. Always check with your accountant/tax advisor.

Facebook

Instagram

LinkedIn

Youtube