When You Solar With

Walker Power

You Solar with Family

OUR ABOUT

We are a Family-Owned, Bilingual, Local Solar Business

Click on the About Us button to know more. See if the Trust we receive from the Quality and Commitment we provide throughout the entire solar process is something you might find as valuable as everyone else does.

English Speaking

We both can help. This is Paul's first language.

Hablando Español

Ambos podemos ayudar. Este es el primer idioma de Jasmine.

1535 +

Happy Clients

1166 +

Projects Completed

8 +

Years Experience

7 +

Awards Winning

Get the Federal Solar Initiative Tax Credit (SITC)

Learn how to get the SITC with tax form examples, a quick video and even a link to the blank forms on the IRS website

Get NJ Solar Money (SRECs)

New Jersey has the highest payments for the production of solar energy. Most commonly called SRECs, the benefit is now called a SuSI. Click below to learn how to get yours

Free Roof...Nearly?

Lots of ads mention a "Free Roof". Most people know that nothing is "Free", so what's the catch. Yes there's a price, but combined with solar it may be less than your current electricity bill. Click to below to learn more.

Featured Information

Here is some of the more important information that you need to know before you decide to Go Solar and join us in the Future!

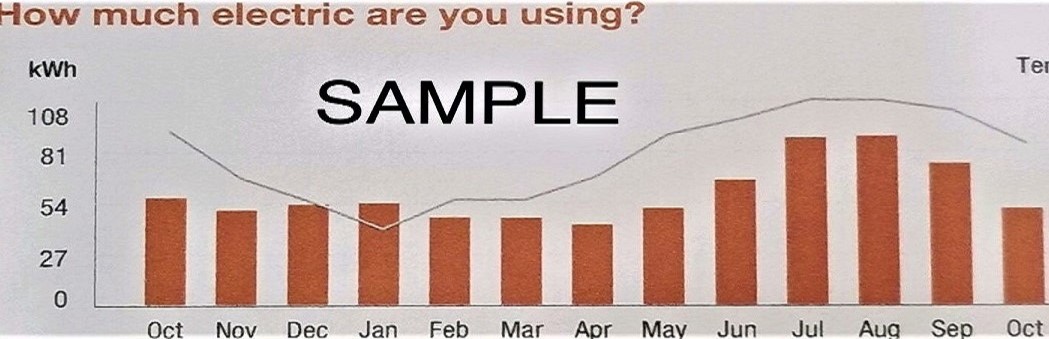

Eliminate Electric Bill

Eliminate electricity charges. Only pay a connection fee from the utility

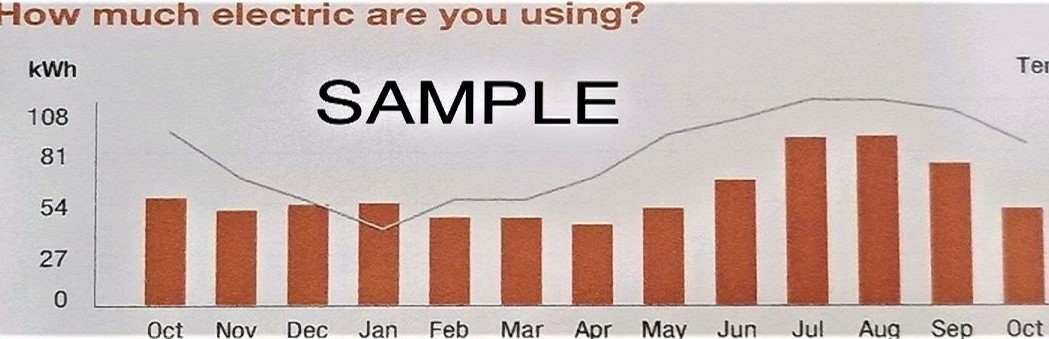

Monitor Solar Production

Our Enphase App shows the energy you make and you use.

Save & Make Money

Stop paying the utility for electricity, Get Federal & State benefits as well

Be a Climate Hero

Help prevent Global Warming and get paid to do it!

Email Us with Questions

When you Solar with Walker Power you Solar with Family!

Get a Nearly Free Roof

You could pay less for a roof + Solar than you currently pay for electricity!

Most Important Videos

These videos are very short but contain a lot of very important information, ESPECIALLY, if you are comparing more than one solar company to complete your solar installation.

A Warning About Choosing the Wrong Solar Company

See what a friend went through and how that felt by trying to save a few bucks.

Learn What to Look for When Comparing Solar Offers

See what a customer with a friend at another company was told by the other company.

Permanently Attaching Solar to Your Most Expensive Investment

That requires TRUST. Has your solar guy earned that from you?

Our Best Service

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula dolor enean sociis natoque penatibus magnis...

Sabiya Sultan

Funder

Rahul Sarkar

Funder

Zahanger Zaven

Manager

Patrick Griffin

Marketing

We Don't Sell Solar to Customers. We Provide Green Energy Solutions to Family.

Email us your questions.

Ask a question with no commitment.

See which option work best for you.

Learn aspects to help you choose better.

Choose a company who treats you like family

Have Any Questions Or Need Help, Feel Free to Call Us.

Solar is for most people but it is not for everyone. Talk to someone who will tell you the truth

Testimonials

Henry Sanchez

Oscar Olortegui

Brian Lee

Copyright 2024, All Rights Reserved

Facebook

Instagram

LinkedIn

Youtube